Adapting the Growth/Share Matrix to Marketing

The Growth/Share Matrix is a business strategy tool that’s been around for years, but it remains a useful way to think strategically about where you make investments and allocate company budgets. Although it’s a general business strategy tool, it can be very useful for thinking about allocating marketing spend and so it is as important for marketers as it is for boards making big strategy decisions. The model is also known as the BCG model, the acronym of the group that created it.

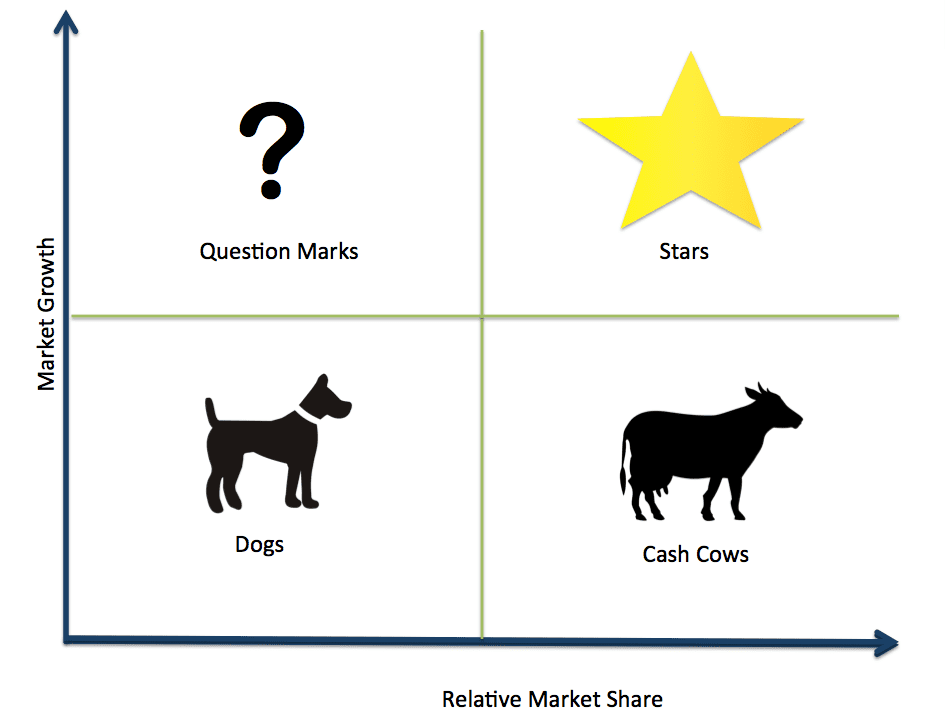

The model involves mapping business divisions or products across two key dimensions; Market Share and Market Growth, which then maps them into one of four quadrants. Products/Divisions operating with low market share in a low-growth market are dogs, those operating with a high market share in a low-growth market are cash cows. Divisions or products serving a high growth market but without much market share are question markets, whilst those that achieve a high market share in a rapidly growing market are stars.

The matrix was originally developed by the Boston Consulting Group, and the idea behind it is that you should sell or disinvest yourself from the ‘dogs’, milk the cash cows for profits, which are then ploughed into stars and question marks. Some of the question marks succeed and become stars, other do not, and become dogs, which you then disinvest from. It makes look business strategy look simple, maybe too simple, but it’s a great framework for evaluating where budgets are allocated and how spending could be shifted to be more effective.

Adjusting the growth share matrix to work for allocating marketing budgets

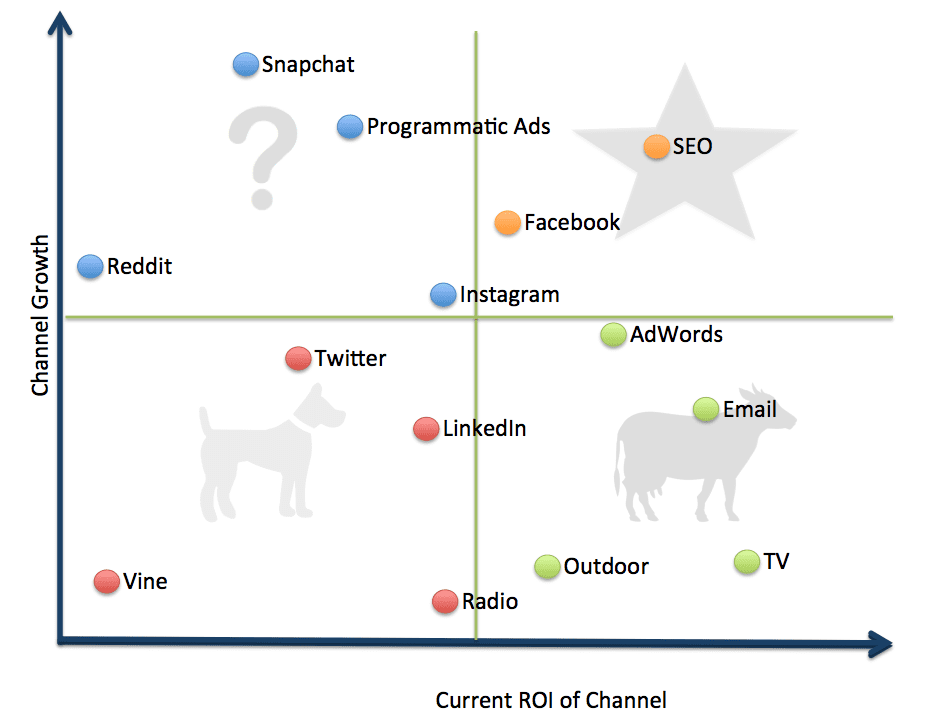

When evaluating marketing spend on different channels it doesn’t make sense to divide the channels up by relative market share, but when planning future marketing budgets it does make sense to judge them by channel growth. A better metric to use instead of relative market share is current ROI from that channel. You can thus see which channels are cash cows because their delivering consistent ROI but aren’t exciting or new, and which are question marks because their not yet delivering great ROI but are growing fast so may be a great investment for the future. Below in an example of a growth/ROI matrix we developed for a large retail business with ecommerce and in-store locations.

The Marketing Growth/ROI Matrix:

It’s important to remember the ROI of a given channel will vary from business to business, so for some Twitter or LinkedIn may be very effective, and could be cash cows, whilst for others a channel like Facebook may not be delivering ROI and so would not be in the star quadrant. The point is to map the channels to the matrix based on how their performance for your business.

This can then let you make spending decisions where you recognize the massive contribution of cash cow channels like TV and Email, which may not be making headlines for growth rates, but are effective in driving revenue. Equally, it can help preventing wasting budgets on 'dogs’ that aren’t particularly fast growing or driving revenue. Some fast growing channels like Snapchat may be yet to prove their ROI but warrant some investment to see if they can become stars. Using the matrix can help jolt you out of the fallacy that all channels deserve a try and need some investment. The truth if a channel showing itself not to be effective for your business the best thing to do is not waste money on it. Milk the cash cows, get rid of the dogs, find out if the question marks work and back the stars to the hilt. A simple doctrine, but one that’s tried and tested. For more tools to help plan your budget allocation for different content formats, see our content marketing matrix.

from Blog – Smart Insights http://www.smartinsights.com/digital-marketing-strategy/online-business-revenue-models/essential-marketing-strategy-models-growthshare-matrix/

via Tumblr http://euro3plast-fr.tumblr.com/post/155340350684

No comments:

Post a Comment