Statistics on consumer mobile usage and adoption to inform your mobile marketing strategy mobile site design and app development

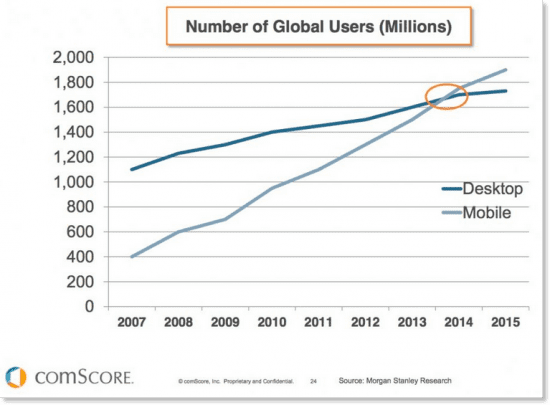

“Mobile to overtake fixed Internet access by 2014" was the huge headline summarising the bold prediction from 2008 by Mary Meeker, an analyst at Kleiner Perkins Caufield Byers who reviews technology trends annually in May.

The mobile statistics that the team at Smart Insights curate in the regular updates to this article include:

- Ownership of smartphone vs Desktop

- Mobile vs desktop media and website use

- Mobile advertising response

- Smartphone vs Tablet vs Desktop conversion rates

Well, we’re now past the mobile Tipping Point as this report from comScore shows. So it’s no longer a case of asking whether mobile marketing important, we know it is! It’s now a question of using the statistics to understand how consumers behave when using different types of mobile devices and what their preferences are.

To help you keep up-to-date with the rise in consumer and company adoption of mobile and its impact on mobile marketing, I will keep this post updated throughout 2016 as the new stats come through to support our 120 page Expert members Ebook explaining how to create a mobile marketing strategy. We also have this free summary mobile strategy briefing for Basic members.

We have grouped the latest mobile stats under these headings for key questions marketers need to answer about mobile to help them compete:

- Q1. Time spent using mobile media

- Q2. Percentage of consumers using mobile devices

- Q3. How many website visits are on mobile vs desktop devices?

- Q4. Mobile device conversion rates and visit share for Ecommerce sites?

- Q5. Mobile - app vs mobile site usage?

- Q6. How important are mobile ads

OK, let’s go!

Q1. How much time do consumers spend using mobile media?

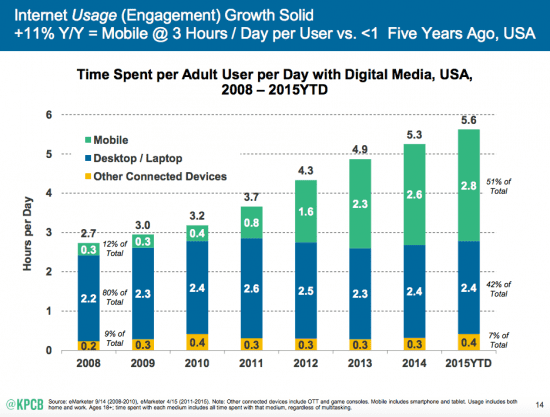

Mary Meeker’s annual spring updates on mobile are a must-read if you follow consumer adoption of technology platforms, so we have used some of the key findings from the latest KPCB mobile technology trends by Mary Meeker. Her deck is nearly 200 slides, so we have selected the statistics which best summarise the importance of mobile devices today.

The latest data shows that we are now well past the tipping point mentioned at the top of this post. Mobile digital media time in the US is now significantly higher at 51% compared to desktop (42%).

The implications are clear - if you’re not able to reach your audience through mobile search or display, or you’re not providing a satisfactory mobile experience you will miss out compared to competitors who are.

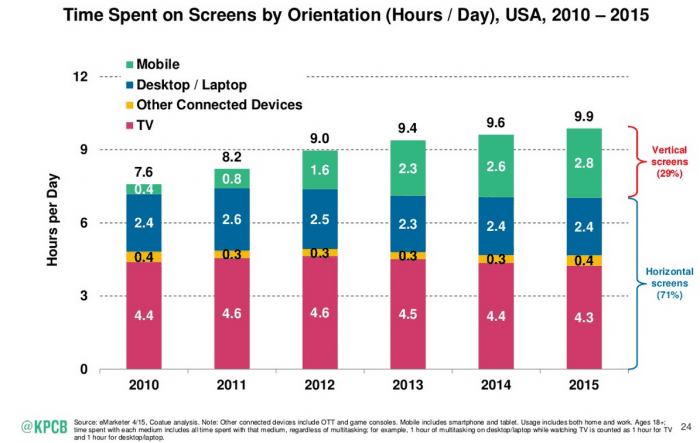

The trend in mobile device usage (‘vertical screens’) compared to all screen use again shows that we’re well past the tipping point.

Q2. Percentage of consumers using mobile devices?

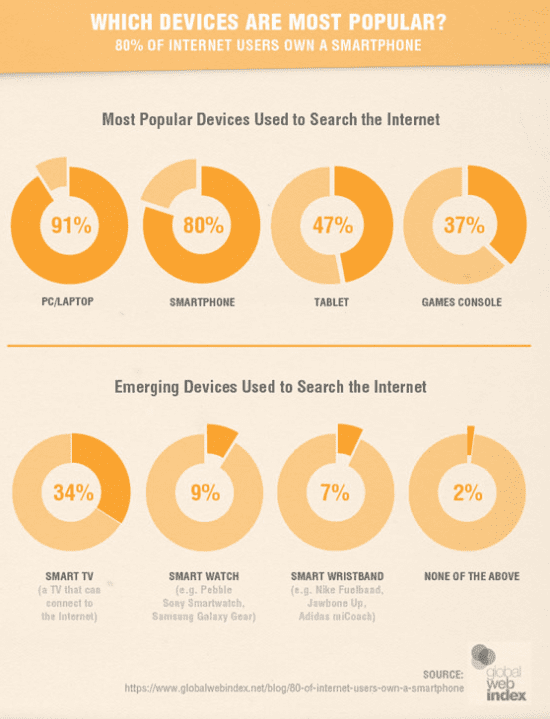

We’ve created a new summary showing the global popularity of using different digital devices using data from Global Web Index to include in for our State of Digital Marketing 2015 infographic.

It clearly shows the popularity of smartphone ownership and emerging mobile devices like Smartwatches.

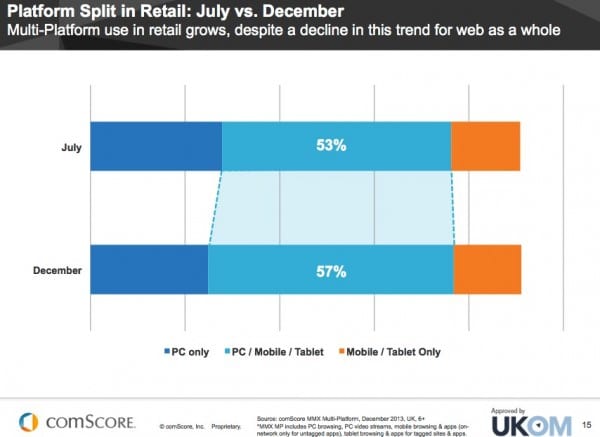

Insight from comScore published in their February 2014 market review shows the picture that marketers need to build up. This panel data shows that the majority of consumers are "multiscreening”, accessing retail sites on mobile or desktop, so consistent experiences across device need to be deployed.

You need to answer this for your own site. As Rob Thurner explained in his post on KPIs to review mcommerce effectiveness, it’s important to keep track of the split between users of mobile and desktop devices visiting your site(s). Using advanced segments in Google Analytics is the best way to do this.

Q3. How many website visits are on mobile vs desktop devices?

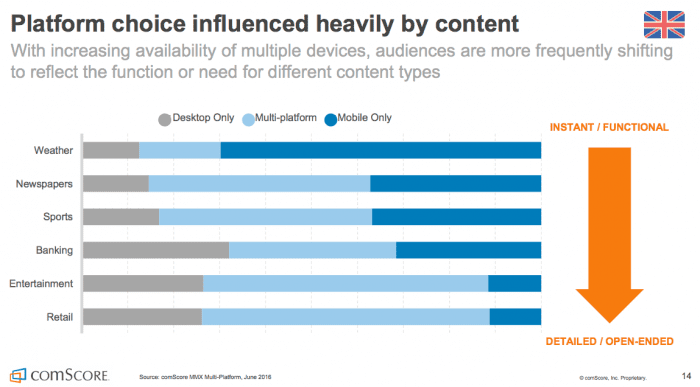

However, we need to be careful with interpreting data on hours spent, since we spend most of our time on smartphones checking email and using social media. This has led to the common mantra of 'mobile-first’ design which I think is dangerous. Eric Schmidt, then Chairman of Google talked about a mobile-first approach. The reality is that while smartphone use is overwhelmingly popular for some activities such as social media, messaging and catching up with news and gossip, the majority of consumers in western markets also have desktop (and tablet) devices which they tend to use for more detailed review and purchasing. So we need to think about strategies to engage what comScore call the Multichannel Majority not simply 'mobile first’ or 'smartphone adoption’. This explains why mobile conversion rates are much lower in retail and why the breakdown between traffic for retail sites is broadly equal between smartphone and desktop. Audience measurement platform comScore has talked for some time about strategies to engage and measure the multiplatform majority across devices and I think there will, or should be more focus on that in the years ahead.

This UK data also shows the importance of the multichannel majority in sectors like Retail and to a lesser extent banking, but that for some niches like weather 'mobile first’ is more accurate.

Their latest data for the US is striking in shows how the multi-device majority dominate, particularly amongst millenials.

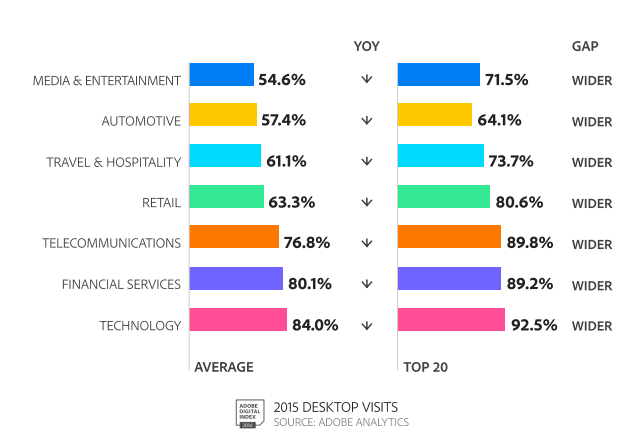

Although mobile is growing in importance, this older data from Adobe’s latest Digital Index (not updated yet in 2016) shows that in all industries the majority of visits are still on desktop.

So with so many site visits still on desktop, it’s important when designing using a responsive web design that the desktop experience isn’t degraded and this has led to many larger businesses using an adaptive web design where layout and content are tailored for desktop, tablet and smartphone screen dimensions.

Q4. Mobile device conversion rates and visit share for Ecommerce sites?

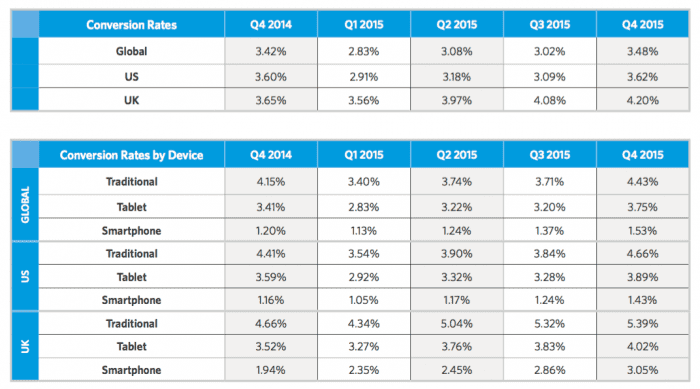

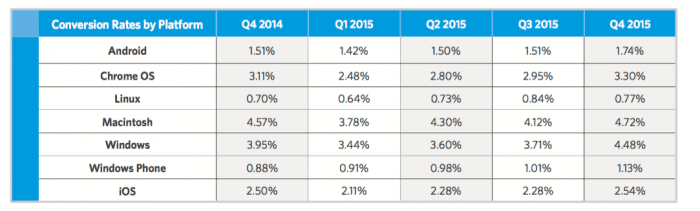

We have a separate compilation of Ecommerce conversion stats if you’re creating a business case for mobile optimised sites as explained in our mobile marketing strategy guide, this data is also valuable since it shows the variation in conversion rate by mobile type. This is the latest data from Monetate for their retail clients showing conversion rates.

The data clearly shows that Smartphone add-to-cart and conversion rates are much lower than for desktop - important if you’re making the business case for a mobile responsive site.

This source is useful since it’s a regular survey showing the growth in use of mobile site visitors. enables you to drill down to see usage by device type, for example iPad is still the dominant tablet, but Kindle Fire and Android tablets now account for over 10% of tablets. You can see that tablet and smartphone use nearly doubled in the year based on 500 million plus visits for these retail clients (see link above for methodology).

Q5. Mobile media time - app vs mobile site usage?

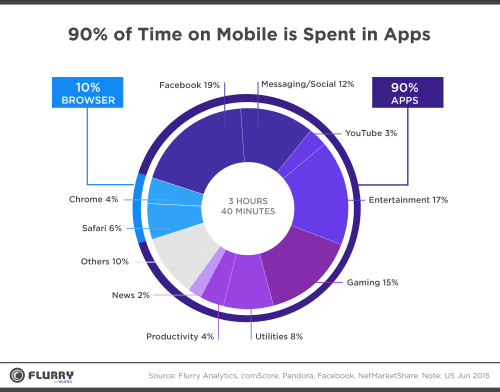

Consumer preference for mobile apps vs mobile sites should also be thought through as part of mobile strategy. This data from Nielsen on mobile media time shows the consumer preference for mobile apps which account for 89% of media time in mobile as might be expected from the use of the most popular social network, email and news apps.

App usage (90% of time) dominates browsers in mobile usage

We reported comScore data in May 2012 that showed that on smartphones 82% of mobile media time is via apps. Today, the latest data from Yahoo’s Flurry analytics shows that 90 percent of consumer’s mobile time is spent in apps. As they put it,put it: It’s an App World. The Web Just Lives in It. This is a key insight as companies decide whether to develop mobile apps or create mobile device specific apps.

This 90% figure is a key insight as companies decide whether to develop mobile apps or restrict themselves to mobile optimised sites. You do have to be careful about interpreting this since, as the chart below shows, Facebook, messaging, games and utility apps will naturally have the greatest time spent and browser use is still significant by volume if not proportion. But this has implications for advertising on mobile to reach consumers using apps like Facebook and Gmail.

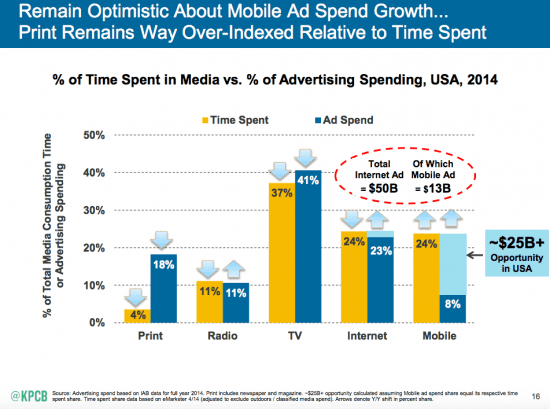

Q6. Mobile Ad Spend still lags behind Mobile Media Consumption

Q6. Mobile Ad Spend still lags behind Mobile Media Consumption

So, how have advertisers responded to the change in mobile media time? The next chart shows that despite the growth in media time above, some advertisers are missing out since the right-most bar shows that there is a huge missing opportunity on mobile advertising

This research sourced from a 2015 study by eMarketer into mobile ad budgets shows a different view. In 2015 mobile ad spending accounts for 49% of digital ad spending, which is only slightly behind the trends of how people are using their devices. These stats also show projections for future growth, which is important as it shows where the market is going. It is clear that mobile is the future, and within 3 years it will come to dominate digital ad spending.

| 2015 | 2016 | 2017 | 2018 | 2019 | |

|---|---|---|---|---|---|

| Mobile Ad spending- Billions $ | 28.7 | 40.5 | 49.8 | 57.7 | 65.8 |

| Percentage change | 50% | 41% | 23% | 16% | 14% |

| Percentage of digital ad spending | 49% | 60.4% | 66.6% | 69.7% | 72.2% |

Q2. How consumers research products using mobile search and review sites

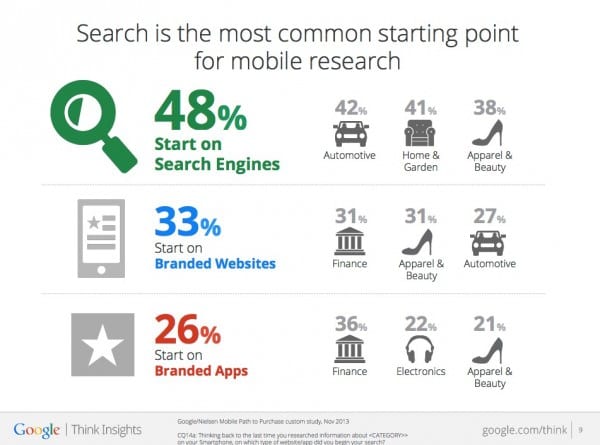

Google’s mobile path to purchase report surveyed 950 US consumers across 9 different verticals (Restaurants, Food & Cooking, Finance, Travel, Home & Garden, Apparel & Beauty, Automotive, Electronics, Health & Nutrition) to assess how they researched purchases via mobile. A key finding is the starting point for mobile research. As might be expected search was the most common starting point, but it’s lower than desktop showing the importance of branded apps and mobile sites.

The 5 best sources for mobile marketing statistics?

This update to this post features some of the latest updates on mobile statistics from 2014 and highlight some of the best sources to make the business case for investment in mobile marketing in your presentations and business cases to colleagues or clients.

- 1. Google Mobile Planet. A regular survey for different countries starting in 2011, this enabled you to prepare your own reports. Now this has been replaced by Google’s Consumer barometer which enables you to create similar reports.

In addition to downloads for each country, you can also create your own charts focusing on KPIs of interest. For example, if you’re based in Australia you can look at usage by demographic.

The weakness of the current data is that it focuses on Smartphones, not tablets. It may be useful for pushing back against over-enthusiastic colleagues or understanding consumer barriers. For example, less than a third of Australians have ever bought on a smartphone and you can see there are barriers of security and preference for desktop purchases.

- 2. ITU. The International Telecoms Union data reports mobile usage including mobile broadband subscriptions to show growth in use of mobile. This reported at country, continent and overall levels, so is the best overall source for mobile penetration worldwide. Much of the information is free - see their free mobile statistics section.

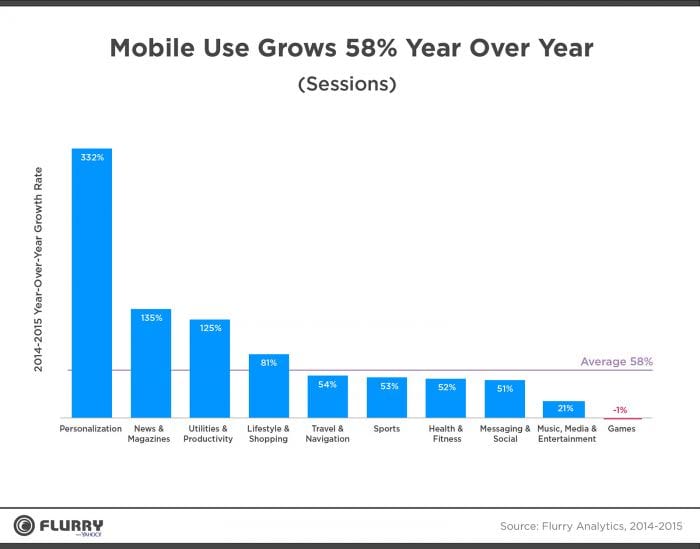

- 3. Flurry Mobile Analytics. This is a great source for showing the overall level of app usage across the four major mobile app platforms by country and drilling down into the popularity of individual apps for different sectors like retail, banking and travel. For example, the latest mobile app growth figures from Flurry show growth of category use by more than 50% in many categories.

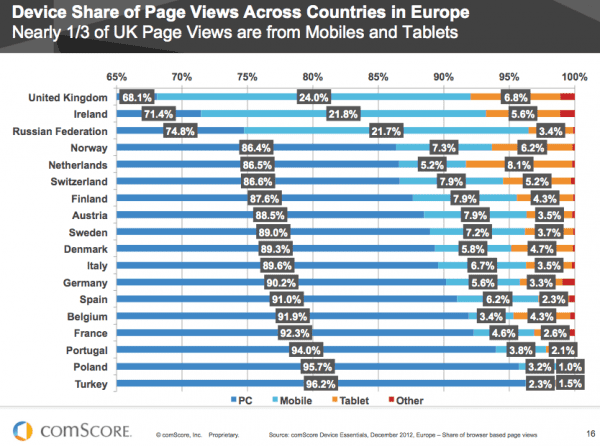

Comscore is one of the key worldwide sources useful for marketers to help us find out about the changes in use of mobile media by consumers. This graph shows the pattern across Europe - follow the link above for US and other country breakdowns.

The report shows much lower levels of adoption in other European countries though - not even a fifth in most. So extrapolating UK behaviour to other countries would seem to be a mistake with the mobile figure still key.

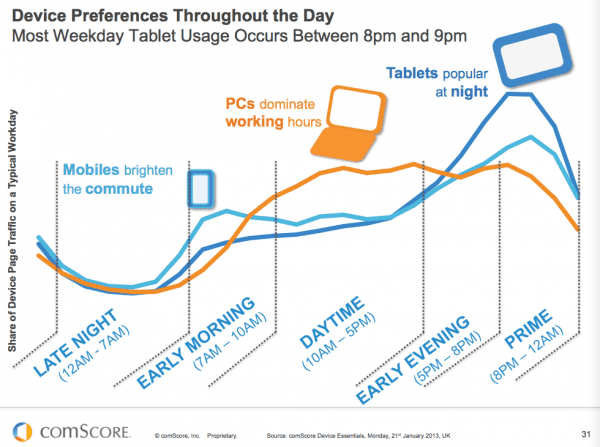

The report also has useful summary of dayparts of different device behaviour, similar to others published.

Retail mobile use

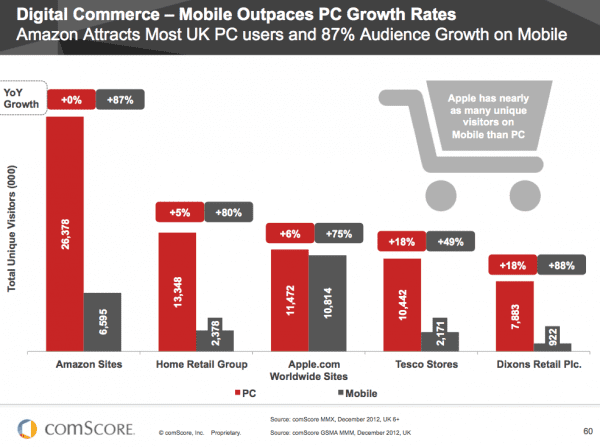

Mobile was again the focus of the section on retail statistics. Audience growth rate is 80% + on mobile in these UK sites, but lower on grocer sites for obvious reasons.

- 5. Ofcom Internet usage report. Ofcom’s Eighth International Communications Market Report was published in December 2014, this examines take-up, availability, price and use of broadband, landlines, mobiles, TV, radio and post across 17 major countries. As example, here’s the picture of desktop vs mobile device in the UK showing that when you look at most important device, desktop and laptop remain important.

We hope this compilation of statistics about mobile usage and effectiveness continues to be useful - please share if it is and we’ll continue to update it in 2015.

If you want a single source of the latest stats across the whole of digital marketing, for Expert members, we compile a regularly updated set of usage statistics to use in presentations - it’s updated each quarter so all the latest stats are categorised in a single place for including in presentations.

from Blog – Smart Insights http://www.smartinsights.com/mobile-marketing/mobile-marketing-analytics/mobile-marketing-statistics/

via Tumblr http://euro3plast-fr.tumblr.com/post/152325978779

No comments:

Post a Comment