I am fortunate in that I get to spend a lot of time with clients on a daily basis and my current portfolio includes 86 agencies. One increasingly frequent topic of discussion at meetings is measurement, ROI and social media in particular.

*For more guidance on social selling, check out our quick win, What is Social Selling and Why is it effective?, which includes detailed advice and activities on the B2B social selling platform LinkedIn. It will help you locate, connect and engage with mre if the right type of people and how to turn them into paying clients.*

Amongst clients across varying sectors I see a lot of focus on owned channels, and I believe the potential of big data enabled by social media is often underutilized. What’s more, with in-house teams growing their own capabilities, agencies will need to diversify where they add value.

Beyond owned, earned and paid are two such areas where consultancy and insight can add real value, and in this post I focus on the measurement of earned social media. Paid, with all its attribution models and programmatic buying, is another post altogether.

PR agencies have an advantage with earned social media, as they already have decades of relationship building experience with journalists and in creating content. Therefore, engaging with social communities and influential bloggers, for example, may come easier to a PR professional than perhaps advertisers. They also know to listen first and not to be the proverbial loud guy at the party - join the conversation, don’t broadcast.

But PR’s do need to step up their knowledge of paid, even if not to execute paid campaigns but to be able to converse on the integration of all activities. Especially as native advertising, in the form of sponsored content, is becoming more and more prevalent and indistinguishable alongside earned media.

What opportunities does social media hold for us when we venture beyond our owned channels?

I’ve put together a short list, which is by no means exhaustive and I welcome your comments to grow and develop this.

Sources of intelligence:

- Campaigns (e.g. how are people reacting to your activities beyond your channels)

- Influencers (e.g. greatest audience vs. genuine influence and influencers vs. advocates)

- Trends and bench-marking (e.g. always benchmark to know where you’ve come from)

- Competitors (e.g. competitors which achieve high engagement rates with their content could help you with ideas for future campaigns)

- Communities (e.g. what are key fashion and health bloggers saying, irrespective of if they mention your brand? Learn so you can join the conversation)

- Subject matter / themes (e.g. sector research on soft drinks or weddings)

- Complaints / reviews (e.g. reputation management)

- Key industry figures (e.g. shifting sentiment on sugar by a given politician could affect you if you’re a biscuit company)

- Crisis management (e.g. the life of a story - how effectively have you handled a situation, do people still tweet about it one week later?)

- Audience research and segmentation (e.g. understand who’s talking about you by analyzing content by demographics)

- Business unit performance (e.g. which Ben & Jerry’s flavour is generating the most buzz and content?)

- Sentiment

- Location

- Second screening and ad correlation (e.g. analyzing time stamps of content can tell you if people were second screening, or if a new ad influenced them to engage with you)

Always consider what the objectives are:

- Generate awareness

- Create leads, increase sales

- Increase sign ups, registrations, app downloads

- Deepen relationship with customers

- Horizon scanning

- Crisis and reputation management

- Research

- Optimise Content

- New product development

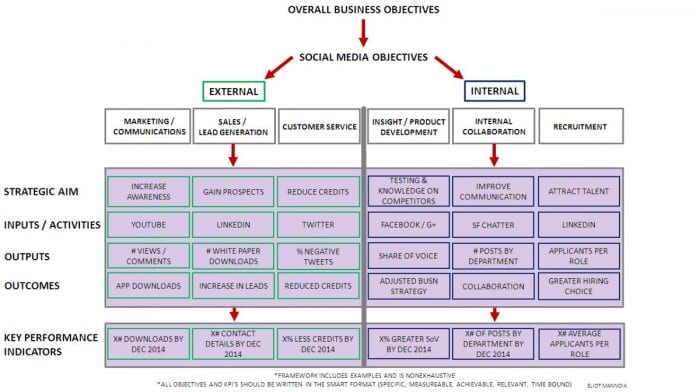

The right mix of what to measure will always depend on your key social media objectives, which in turn must always tie in with the wider business objectives.

I have seen communications strategies unaligned with the overarching businesses objectives, and doing so may well work from time to time, but it can jeopardise the longevity and perceived performance of an activity/campaign.

I would strongly recommend to start at the top, the business objectives, and then work your way down.

Framework for setting your business and social media objectives

Below is a framework which I have put together that can be used as a rough guide. (Message me @eMannoia if you would like a blank framework to use and I can send you one.)

Here a sample framework I completed:

Ideally, you should use one measurement framework, but different metrics for different objectives. Where possible, utilizing metrics which the wider business employs such as sales, Net Promoter Scores (NPS), market share, footfall, ROI etc. will streamline reporting up to senior management and make it more effective. Always link results back to business objectives.

Be aware of some common pitfalls:

- Twitter impressions - Aggregated impressions, which are simply added up followers, will quickly give you figures in the millions but as Danny Sullivan writes ‘you may have to tweet 14-21 times in a week in hopes of reaching only 30% of your total audience’. Twitter can provide you with actual served impressions, other providers will just show total potential impressions.

- Sentiment - As this is automated the accuracy can sometimes be atrocious. More so when you’re a consumer brand such as Red Bull, where people may say 'I’m dying for a Red Bull’, 'Red Bull is sick’, 'Red Bull is badass’ etc.

- Scores - Such as Klout can lack transparency, context and can be rigged

- Location - Facebook, Tumblr, some Twitter content and other .com domains can skew the results to appear to be originating from the U.S.

A holistic measurement solution should capture both quantitative and qualitative results, utilising social listening tools, social campaign execution tools, web traffic data and ideally sales figures. That’s when you can go beyond measuring simple outputs, and look at actual outcomes. This is when you can prove a return on your investment.

Did a spike in content after a given campaign cause a surge in sales, sign-ups, museum visits or, if you’re a charity, volunteers - is there a correlation?

Multichannel integrated campaigns are almost the norm these days, so for a more sophisticated analysis of contribution one can also use econometric modelling. Besides correlation analysis and econometric modelling, market research is another tool which can determine behavioural shifts, changes in NPS and general awareness.

Also keep an eye on the absence of data and the corresponding insight derived from that, and conversely, do not simply measure data that’s readily available but perhaps not relevant. Once you have the results and look to interpret them remember, as Rob Clark put it, ’Not what, but so what and now what’.

For more information on social media measurement frameworks you can also see AMEC’s detailed resources, Cisco and Stephanie Marx’s approach or Susan Etlinger and Altimeter’s blog.

What intelligence do you gather?

from Blog – Smart Insights http://www.smartinsights.com/social-media-marketing/social-media-analytics/social-media-intelligence-2/

via Tumblr http://euro3plast-fr.tumblr.com/post/166212545824

No comments:

Post a Comment